It’s officially tax time my friends. Normally this would be a celebratory period where you excitedly calculate what will probably be a juicy tax return of at least $1,500 — perfect for booking that holiday you desperately need, or actually being able to afford groceries. But not this year.

This year is the first tax season since the 2018/2019 financial year that we don’t benefit from the low and middle income tax offset (LITMO).

It was introduced to give a tax benefit of up to $1,500 for those who earned between $37,000 and $126,000. If you earned between $40,0001 and $90,000 you got the full $1,500.

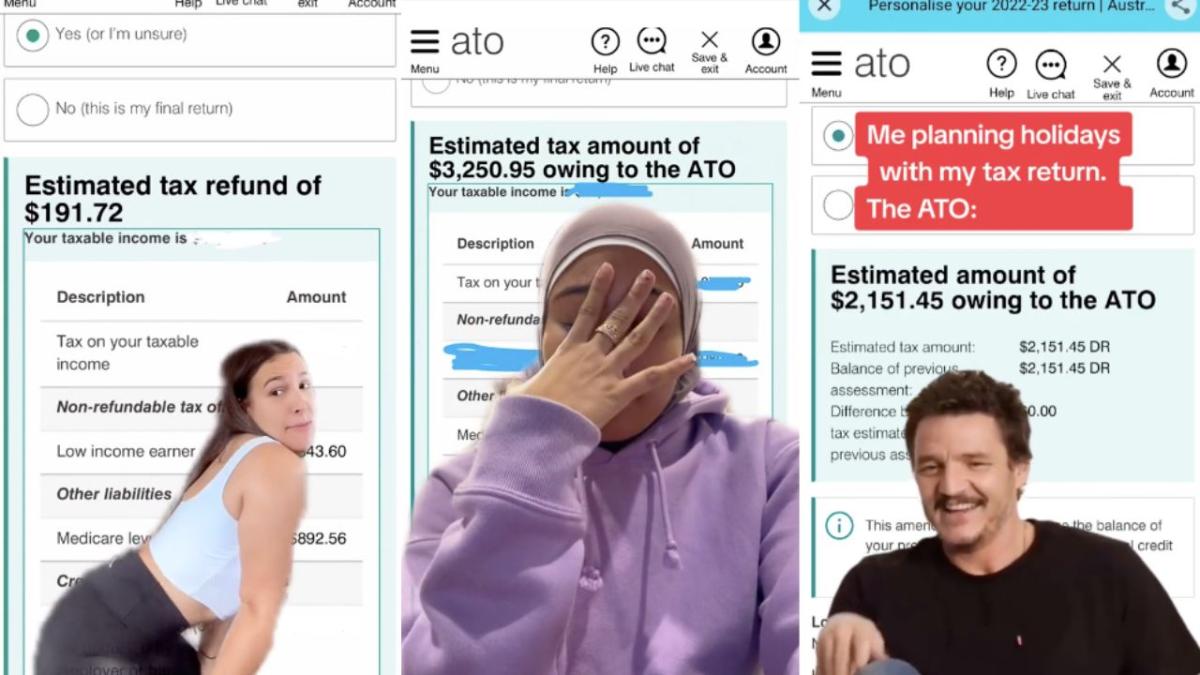

Now that the LITMO has been dissolved, and if the influx of tragic TikToks is anything to go by, lower and middle income Aussies are finding their tax returns to be sad AF.

Some people are even finding themselves owing money to the ATO. Not great, especially for those already being taxed in their monthly pay cheques.

Workers have taken to TikTok to vent their frustration, with some people owing literal thousands to the ATO when they were expecting a refund. Imagine thinking you’re about to get a nice thicc cheque, only to find out you’re about to be thousands in the negative.

While the complaints are totally understandable, there’s also been some gross classism rearing its ugly head on social media as workers blame people on Centrelink for their higher tax.

News flash, people on Centrelink are kept well below the poverty line because of their extremely marginal welfare payments — I assure you, your taxes are not being concentrated there, and you’re turning on the wrong people.

Your rage should really be directed is at the government’s prioritisation of keeping the rich wealthy. Instead, campaign to bring back LMITO, or at the very least, to tax billionaires more and us less.

Lord knows those who earn the most in our country often benefit the most from tax cuts. Make it make sense.