I love shoving my schnoz into everyone’s business. And in defence of being a busy body, I reckon it really does serve me well. Knowing how everyone else does their thing informs the way I move through the world. It makes me more thoughtful about certain routes in life, or things I say. Also, it’s fun. Please tell me all your secrets.

When it comes to the big, juicy topic of money, we’ve gotta be more loose-lipped. (It makes my life hell trying to pry the details out of you private people.) But seriously, knowing what other people are earning, spending and saving can help us all out. For starters, it can be reassuring to feel like you’re not the only one making financial fumbles. Or, if you’re hanging out with a friend that you know is in saving mode, chances are you’ll reign it in, too. Handy.

So, now that we’ve established it’s good to be nosy, let’s snoop a little more, shall we?

Show us the money

We polled our audience to get the dirty deets on how much we’re all saving weekly. And, let’s just say, instead of making me feel better, it gave me a bloody wake-up call. Hoo boy.

Up to 20% was the most common percentage of a pay check that people aimed to chuck into their savings. And, naturally, we don’t always meet those goals, do we? In reality, 24% of you never meet the goal you set to save from your pay check, and 11% always do (good on you).

When we’re talking specific dollarydoos, 19% of you straight-up save zilch per week. 22% save under $150, while 28% save between $150 and $350, and 31% save over $350. (Sorry, but who the hell are these super-savers???)

We also opened the floodgates to find out what exactly this diligent saving is all going towards. A house was overwhelmingly the most popular response. Other big ones included weddings, renovations, travel, cars, petrol and emergency funds. How sensible, folks.

So, that’s what you told us. But, we’re sussing out some more data for the country. Just to find out if you were telling any fibs.

Varied saving habits

The way Aussies save is a mixed bloody bag. A 2021 report found that one in five Aussies saves nothing each week – but also that the average person saves $377 per week. See what I mean? Wide net. But also, I guess our poll data checks out. It’s all way higher than you’d expect!

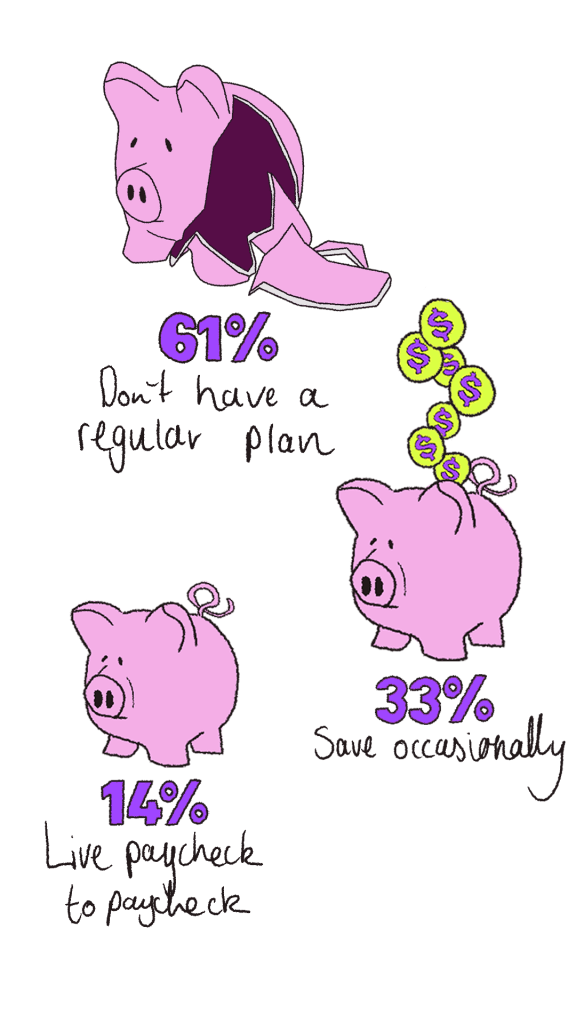

When it comes to the young punks, specifically, research undertaken in 2021 found that 61% of 24-39 year-olds don’t actually have a regular savings plan. About 33% of them save occasionally, while 14% live paycheck to paycheck.

Money in the bank

We’ve found some young Aussies are slinging lots of cash into their account, others are struggling to keep with it, and there’s some who aren’t saving a cent. So, how are our accounts actually shaping up?

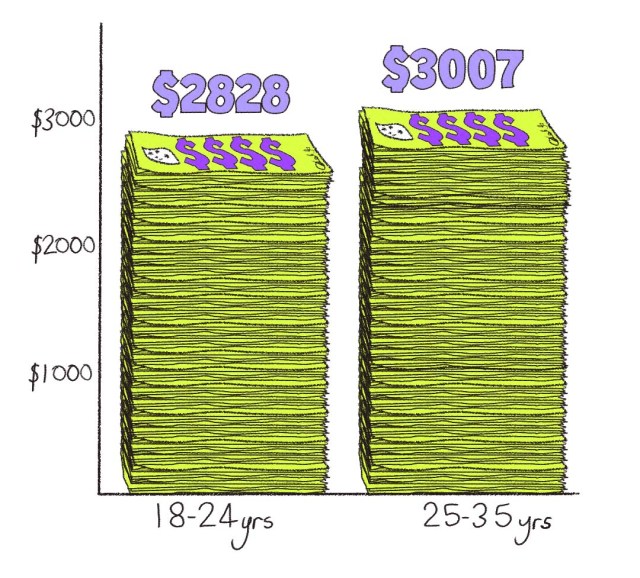

Data from one of our big banks showed what Aussies had in their accounts as of the last day of 2021. For 18 to 24-year-olds, the average dosh in your savings was $5,147, and the median was $2828. And for 25 to 34-year-olds, the average in our accounts was $7,995 and the median was $3007.

Also, I spent ages looking for a simple explanation on the difference between averages and medians because I’m too pretty to know that kind of stuff. So, PSA: an average is the sum of all the values in a data set, divided by the same number of values. It can skew if a few bits of data are super high or low – in this case above there were some super-rich outliers. On the other hand, the median is smack-bang in the middle of all the data – the same amount of data is on either side of that middle number – so the medians above are a good picture of where your peers are at.

Get nosy when it comes to money. The more we know and chat about our money stories — what we reckon is worthwhile splashing out on, and where we can save – the more it’ll give us a leg-up going forward.

Now, if you’ll excuse me, I’m going to have a long, hard look in the mirror.

Please note that this information is general in nature and shouldn’t be construed as financial advice.