We love a sticky-beak. Especially when it comes to money. It’s such a touchy thing to talk about, that it either gets avoided altogether, instantly upstaged by something less controversial, or danced around in loosey-goosey terms. Which only makes us want the goss even more. We keep our own money so steeped in ~mystery~ that it makes us absolutely parched for the deets on everyone else’s.

But we shouldn’t be keeping money cloaked in darkness. We need to learn our own money stories and habits in order to get a handle on them and keep taking steps towards a positive future. Which is basically a nice way of saying we’re going to be extra nosy for you.

We asked a bunch of young Aussies to fess up about how they earn their sweet, sweet cash. Which, after the merry-go-round of madness we’ve been on for two years, is all the more intriguing. Are young Aussies working full-time, post-pandemic? Have they taken up a wild side-gig? We’ve sussed it all out.

We polled our audience to get a snapshot of the big picture. Cop a load of this:

- Full-time work is your main source of moolah right now (62%)

- 13% of you work part-time

- 14% of you work casually

- 11% are unemployed right now

- 56% of you have done something on the side to earn money

If that huge chunk of young Aussies jumping on the side-gig train has made you want to hop on too, fair enough. We do love to be part of the majority, hey.

If you are going to juggle work with a side-gig, you need to keep track of everything coming in and out. An extra stream of income means you need to be extra diligent. With extra side-gigs on the go post-pandemic, the Australian Tax Office has warned that they’ll be on the lookout for undeclared second incomes. Keep everything under control to avoid getting in trouble.

So, if you’re also wanting to boost your funds a bit but not sure where in the world to start, check out what some of your peers are doing below.

Leaning on those digital skills

If I had a dollar for every time I’ve had to (not so) patiently walk my mum through the difference between a tab and a window on her computer, my god, I could have had one helluva weekend in regional NSW by now.

In all seriousness though, as a digital-first generation, a lot of stuff comes more naturally to us than we realise. While, obviously, you’ve got to get a bit more advanced than tabs vs windows, you might just have the right digi skills under your belt to make some extra dosh.

In a 2021 report into the side-hustle economy, proofreading and editing, 3D and 2D modelling, animation, web design, SEO (search engine optimisation) services, video editing, social media advertising and blog post services all cracked the top ten-earning side-gigs in Australia. Money talks, my friends. And it’s screaming in the digital world.

In a more general sense, we’re betting your digital savvy could come in handy for something as simple as an Airtasker request from an oldie that needs a bit of computer help. And you’d probs make the sweet ol’ bird’s day, while you’re at it.

Adding a few extra skills to your arsenal

As a digital native who knows the difference between a Google search and a Facebook status, you’re already one step ahead of many, many people. However, that doesn’t mean you couldn’t learn a thing or two. There are countless websites offering courses to help you maximise your digital knowledge. From coding to editing, some even give you qualifications necessary to land a full-time tech job if you’re bored of your current nine to five.

In 2022, the great resignation is a very real thing. People are reevaluating their values and what employment means to them. With many workplaces switching to flexible working from home arrangements, flexibility has become a bargaining chip that many businesses can’t afford. Instead of heading back to stuffy offices, Gen Z are finding new avenues such as virtual assistants.

Passion projects

Our polls showed off the massive variety of creative projects young Aussies have pursued to chalk up some extra cash. From hand-made embroidery to photography, you’re a talented bloody bunch.

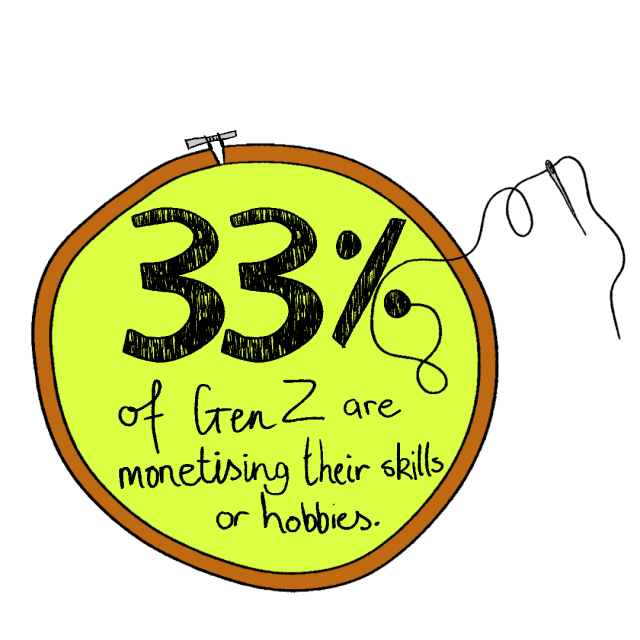

And it’s common, too. According to more research undertaken in 2021, flexibility (52%) and a drive to turn passion into profit by monetising skills or hobbies (33%) is influencing Gen Zs career choices.

So, if you’ve been dabbling in ceramics for a bit of fun lately, keep it up ‘cos you could eventually start charging for those bad boys.

Getting into investing

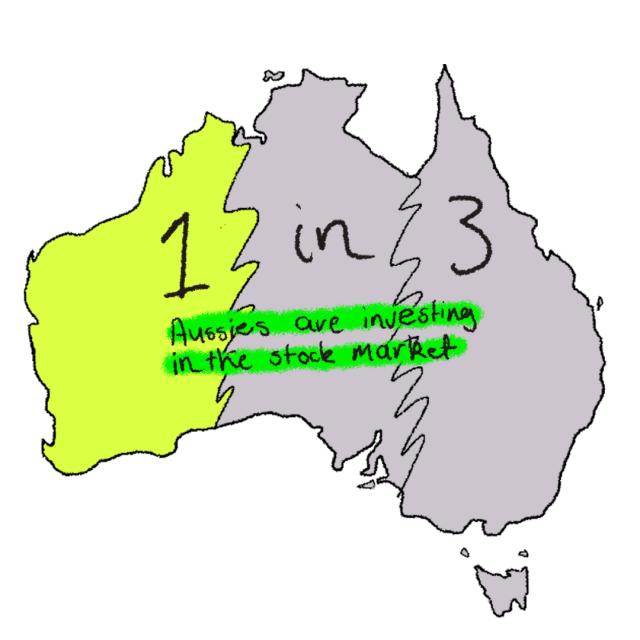

If it feels like everyone is blabbing to you about investing right now, that checks the hell out. Research shows that more than one in three Aussies are investing in the stock market, with millennials (46%) and Gen Z (42%) the most likely to do so.

With a stack of easy-to-invest digital apps on the scene these days, with low-cost entry into the market, it’s no wonder young Aussies are throwing their dollars into the ring. In short, investing in stocks is putting your bucks on the odds of compound interest which sees the value of your investment grow, or compound, overtime. If you play the long game and put a little nest egg away for your future, sexy self, you’ll be in for a little treat.

Selling stuff online

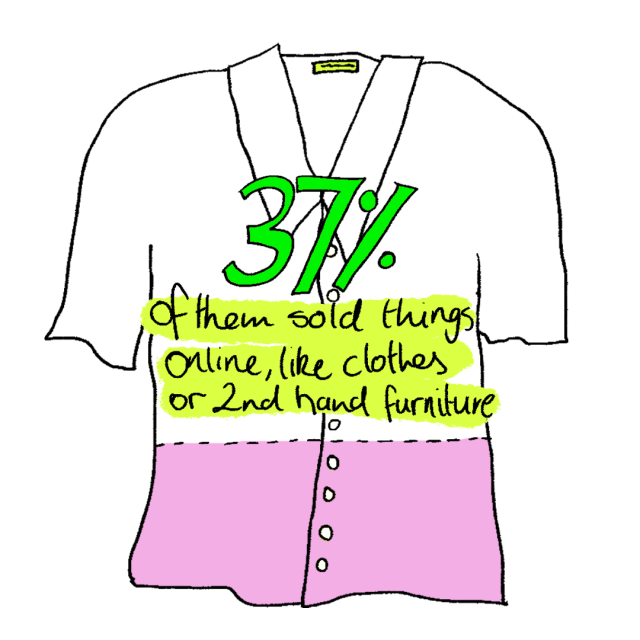

In a recent report where Aussies surveyed either already had a side-gig, or were planning to start one, 37% of them opted to sell stuff online. Whether it’s finding a new home for clothes on Depop, or refurbishing old furniture to then upsell on Facebook Marketplace for a pretty penny – it’s worth a look into.

Feels good to get a glimpse into how others are doing it, hey? If you’re getting into the side-gig game, try one of the above on for size. Either way, keep talking about money with your pals – it helps us all!

Please note that this information is general in nature and shouldn’t be construed as financial advice.