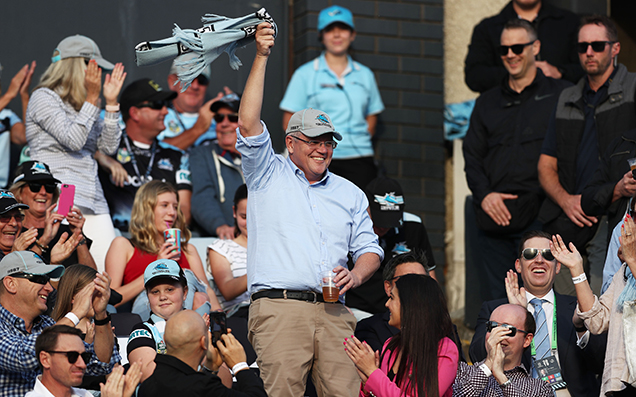

When running on a platform that revolved primarily around income tax and not much else, it should come as, I don’t know, *maybe* a shock to learn that just three days after the election, Prime Minister Scott Morrison looks likely to walk back on a promise that served as a central core of the Coalition’s now-successful re-election campaign.

[jwplayer x2bUKSnW]

One of the meatier takeaways from this year’s Federal Budget was an income tax offset that would’ve seen 10 million workers gifted a rebate worth as much as $1080 per person, per year, that was set to be paid to tax payers as a lump sum that would have been bundled in with people’s tax returns this year.

Delivering that offset by the end of this financial year was a key talking point for the Morrison Government in both this year’s Federal Budget and the ensuing Federal Election campaign.

But advice from ATO officials and a delay in formal post-election procedure is making it very unlikely that Parliament will be able to sit in time for legislation to be passed before the end of the financial year, meaning the offset will not be included in this year’s tax returns, and one of the returned Morrison Government’s first big KPI’s will be missed.

Federal Parliament is unable to be recalled until election writs are returned following the conclusion of an exhaustive vote count, which at this stage doesn’t look likely to occur until late June.

That would give Government very little time to pass the legislation required to have the offset included in people’s tax returns; the Australian Tax Office cannot deliver the offset to Australians without legislation passing that enables it to.

Morrison is almost certain to have known this ordinary procedural issue would occur when delivering the budget and campaigning for the election, meaning any promises made regarding it were either deliberately misleading, wilfully ignorant, or economically irresponsible.

This whole debacle leaves the Morrison Government in the awkward position of having to look at retrospective action post-July 1st that would enable taxpayers to access the offset at an unspecified later time, effectively gifting people a one-off lump sum payment not unlike the delivery of the Rudd Government’s economic stimulus package in 2009.

Under the offset, people earning between $48,000 and $90,000 annually would receive a $1,080 rebate. Those earning below $48,000 would receive marginally less, and the rebate would scale down for those earning $90,000 and above, with it ceasing to apply for incomes of $125,000 and above.

Morrison spoke to Sky News and admitted the offset, which was a jewel in the otherwise thin crown of Liberal Party election policy, was unlikely to pass Parliament before the end of the financial year.

We hope to convene the Parliament again as soon as we can. We obviously have to wait for the writs to be returned and there’s a formal process for that. At the moment that’s not looking until very late in the back end of June, so that really does make very narrow that opportunity to do it before the 30th of June.

I think that’s very unlikely with the advice I’ve received.

Three days.

That’s how long it took.