There are two types of people in the world: the type who want a uniform and cohesive system of taxes placed on alcohol in Australia, and the type who don’t want the price of goon to skyrocket over 200%.

Yes, yes, calm down. We all know possible alterations to the tax system are exhilarating, and no doubt you’re absolutely chuffed to hear the Foundation for Alcohol Research and Education (FARE) has proposed a new tax framework. It’d bring cheap plonk in line with spirits and beer; as it stands, Fruity Lexia makes you sexier and its ilk are taxed based on their retail price, rather than their total alcohol content.

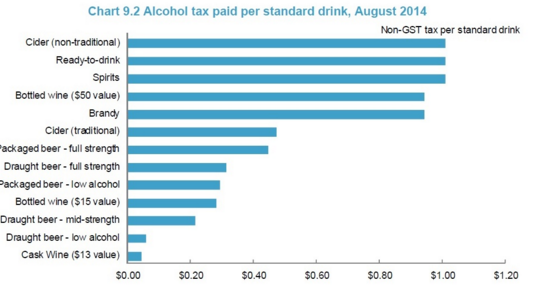

Low goon prices = low excise. Currently, each standard drink from a cask

flips around four cents into the taxman’s coffers, compared to nearly 40 cents per drink of full-strength beer. If FARE’s new model was reflected in, say, the upcoming

Federal Budget, it’d mean cask wine would face a volumetric excise of around $56 per litre of alcohol – just like brews and distilled drinks.

Here’s how a report whipped together by Joe Hockey in 2015 showed the excise differences, to give you an idea of how easy goon has been getting off:

FARE reckons the amendments would not only generate nearly $3 billion in revenue for the Government, it’d drop the level of alcohol consumption considerably.

Obviously. Proponents also say it’d be fairer on smaller Australian wine producers, who don’t enjoy the same tax leniency the big goon-churners do.

The move has also been supported by other alcohol advisory groups for its supposed merits to both the financial and public health sectors, and been in support since changes of this kind have were tossed around last year. Regardless, nothing has been put into place – yet – so you can still get your hands on the finest February 2016 vintages on the cheap.

Salud.