There are two types of people in this world: those who ask everyone how much rent they pay, and those who think it’s rude. Regardless of which camp you land in (I’m the former, but I get the latter), we all want to know, which is why we asked you all for the dirt — and then did our own research to get a fuller picture of life as a young renter in Australia.

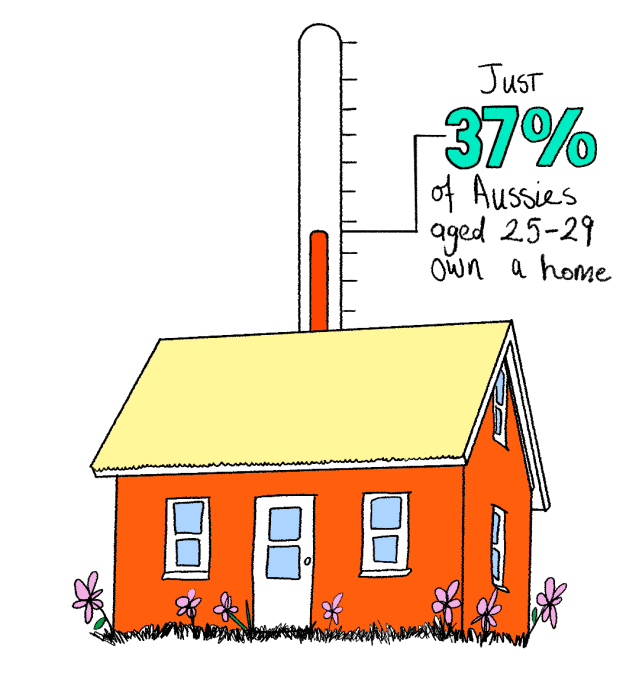

It’s not merely a question of knowing everyone’s business: transparency around financials helps everyone in the long run, allowing us to take control and better understand our own money stories. And given that home-ownership is at its lowest – just 37% of Australians aged 25 – 29 owned a house in 2016 – it’s now more likely than ever that young Australians are renting.

After over 1200 people responded to our poll, we learnt a little bit about how you feel about renting. In short, the majority of people aren’t stoked with what they’re forking out for their place.

Only 43% were happy with their rent costs, and 29% of people were resigned or accepted that they’d be renters for the rest of their life. The most common bracket for what respondents shell out for rent fell between the $300 and $450 mark. We also asked what you found was the ‘biggest pain point’ when it comes to renting in your home state, and answers varied from a lack of security to limited availability, rental increases, repairs never being done, an inability to save, and bad landlords and property managers. And, of course, Sydney was specifically roasted for being so expensive.

So that’s, to paraphrase Charli XCX, how we’re feeling now. But using data from Domain‘s most recent quarterly rental report, published in December 2021, we can see what the actual average cost of renting homes and apartments are in our cities, so you can know whether you’re getting a good deal.

The Most Expensive City Is…

You might expect Sydney to be Australia’s most expensive city to rent, but on average, it’s currently Canberrans who are paying the most, with the median house and apartment in the nation’s capital costing $675 and $530 a week respectively.

Canberra is currently in the strongest rental upswing since 2007, with a 12.5% (houses) and 7.1% (apartments) increase annually.

Sydney isn’t far behind, coming in at a median of $600 (a 9.1% annual increase) and $490 (a 4.3% increase), followed by Darwin at $600 and $480, which is actually a decrease in the quarter and a sign the recent spikes (houses are still 9.1% more annually than last year) are ending. Rounding out the top five most expensive cities to rent are Hobart ($500, $428) and Brisbane ($480, $420).

If you’re surprised, that’s because the median only tells part of the story (remember high school maths?). Sure, Sydney might land behind Canberra on a median scale, but a rental house in a trendy or central suburb like Randwick ($1,100) or Newtown ($750) is well and truly above that price. Domain lets you enter your suburb to compare house/unit prices FYI, which is a nice way to see where you stand on a local level.

The Cheapest City Is…

After a turbulent two years, Melbourne‘s rents are on the rise but remain the lowest for now. The median house rental is $445 a week, with $375 for apartments, though with border openings, demand is expected to help prices surge in the coming year.

As with Sydney, the median only tells part of the story: the likes of a home in Carlton North ($668) or Brunswick ($590) are noticeably above $445.

Melbourne’s closest competitors for cheap rent are Adelaide ($450 for houses, $360 for apartments) and Perth ($460 for houses, $390 for apartments).

Ultimately, the median statistics help you gauge a broad picture, but naturally don’t account for each property’s pros and cons. We all have our own money stories — what we believe is worthwhile spending a little extra on, and what we can trim. Try tracking expenses and income to suss your story out.

Please note that this information is general in nature and shouldn’t be construed as financial advice. Money by Afterpay is a product from Afterpay Australia Pty Ltd (ABN 15 169 342 947, AFSL 527911) with accounts and debit cards issued by Westpac Banking Corporation (ABN 33 007 457 141, AFSL 233714). T&Cs apply.