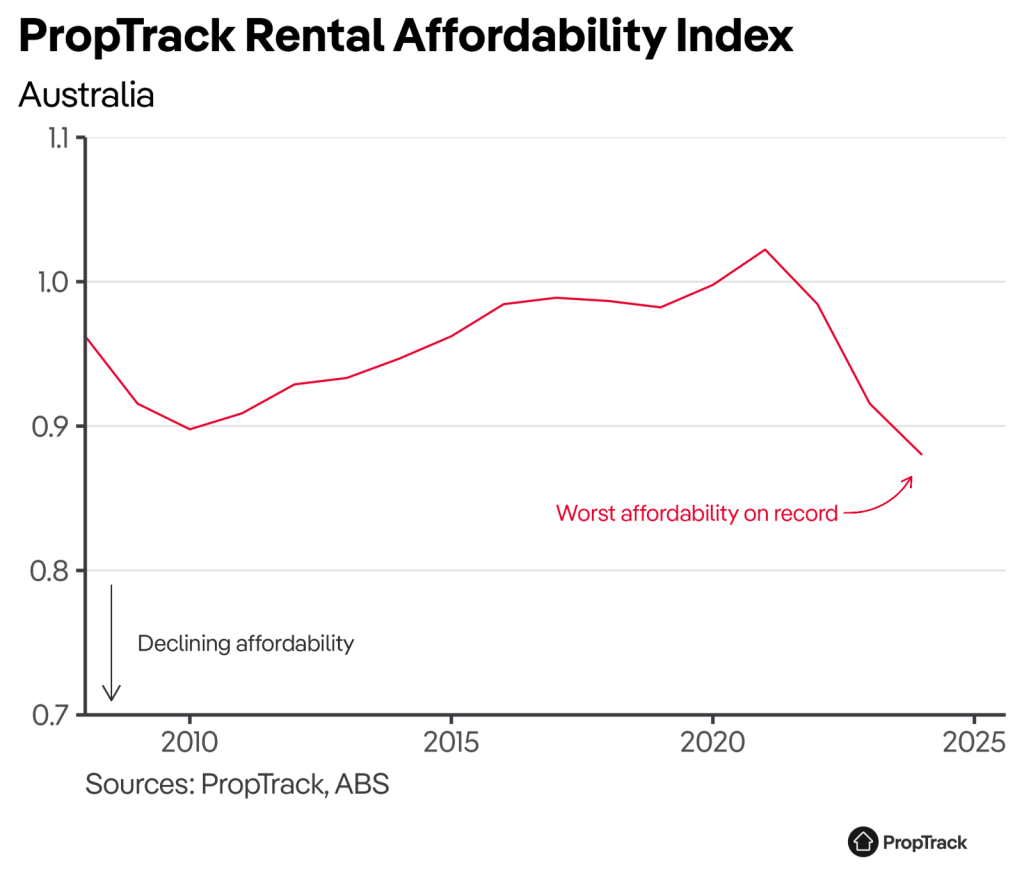

If you’re one of the millions of Aussies who feel that the rental market is tougher than ever ATM, then let us confirm your suspicions. New research has shown that rental affordability in Australia is at its lowest point in the last 17 years.

New studies from PropTrack has revealed that the affordability of rent in Australia is currently at its lowest point since the records began in 2008.

No wonder people are moving back in with the ‘rents to avoid the rents.

According to PropTrack, this affordability low is (unsurprisingly) the result of high rent and low wages.

“The deterioration in affordability has been driven by the significant increase in rents that we’ve seen since the pandemic, which wages have not kept pace with,” said author of the research paper Angus Moore.

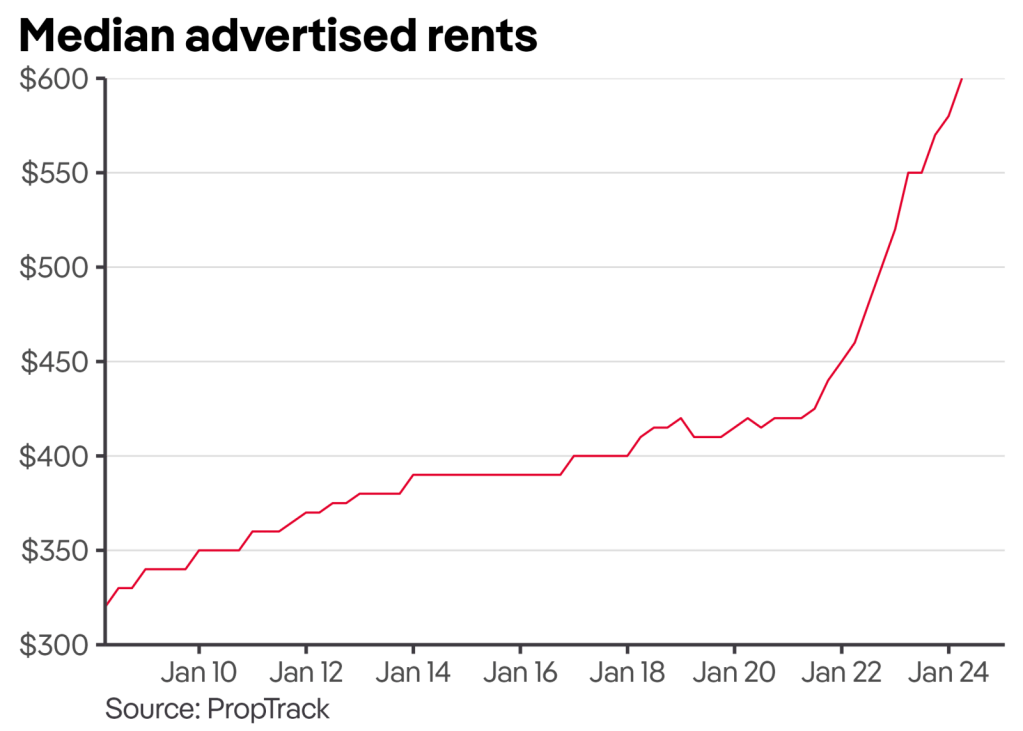

“Rents nationally are up 38% since the start of the pandemic.”

Notably, rent in Australia is currently even less affordable than it was during the 2008 Global Financial Crisis. Which will be a fun brag to tell your kids in 20 years, when you’re raising a family of four in a studio-apartment that costs $4K a week.

Some of the states where rental affordability is at its worst include New South Wales, Tasmania and Queensland. Victoria is currently the most affordable by comparison, but is still also at a 10 year affordability low.

And just in case you weren’t feeling sorry enough for renters in the current situation, here’s a shocking graph that shows exactly how much the price of rents have spiked since 2022.

With the median of advertised rents jumping by over $150 in less than two years, the report points out that at the rate affordability is dropping it will continue to be effectively “impossible” to pay for any household earning under $67K a year.

So basically, unless you are with a partner or a share-house, ya dun screwed.

The report highlights that unless the all levels of government step in to fix the system, it’s not going to get better.

“Given the challenging state of affordability, now is the time for all levels of government and industry to act so we can improve housing outcomes for current and future generations,” said Melina Cruickshank, REA Group’s Chief Product and Audience Officer.

This week MP Max Chandler-Mather announced a new policy that the Greens would be running in the next federal election which would aim to build 300,000 new homes in the next five years that would only be available to buy for first-home buyers. Alternatively, these homes would only be rented out by the government at a cap of 25% of the tenant’s income.

The Labor Government announced a new housing equity policy called the “Help To Buy” scheme that would help 40,000 families buy new homes.

PropTrack is data firm that analyses property owned by the group that owns realestate.com.au.