The Federal Government has today announced a number of big changes to the JobKeeper program, and thankfully, that means heaps more Aussies could be eligible for that sweet cash money.

Following the unprecedented stage 4 lockdown across Melbourne, the government has introduced a number of new measures that are estimated to cover an additional 530,000 people under the JobKeeper scheme.

The changes are expected to add an extra $15.6 billion to the JobKeeper bill, bringing the estimated total to a whopping $101 billion.

So what exactly are the changes?

For Individuals:

In an attempt to cover more workers in the wake of the second wave, the Federal Government has changed the eligibility deadline for the JobKeeper payment, thus making it easier for Aussie workers to qualify.

Previously, you had to be employed before March 1, 2020 to qualify for the payment (provided your workplace is eligible). However, the new changes mean that anyone employed as of July 1, 2020 will now qualify for the payment.

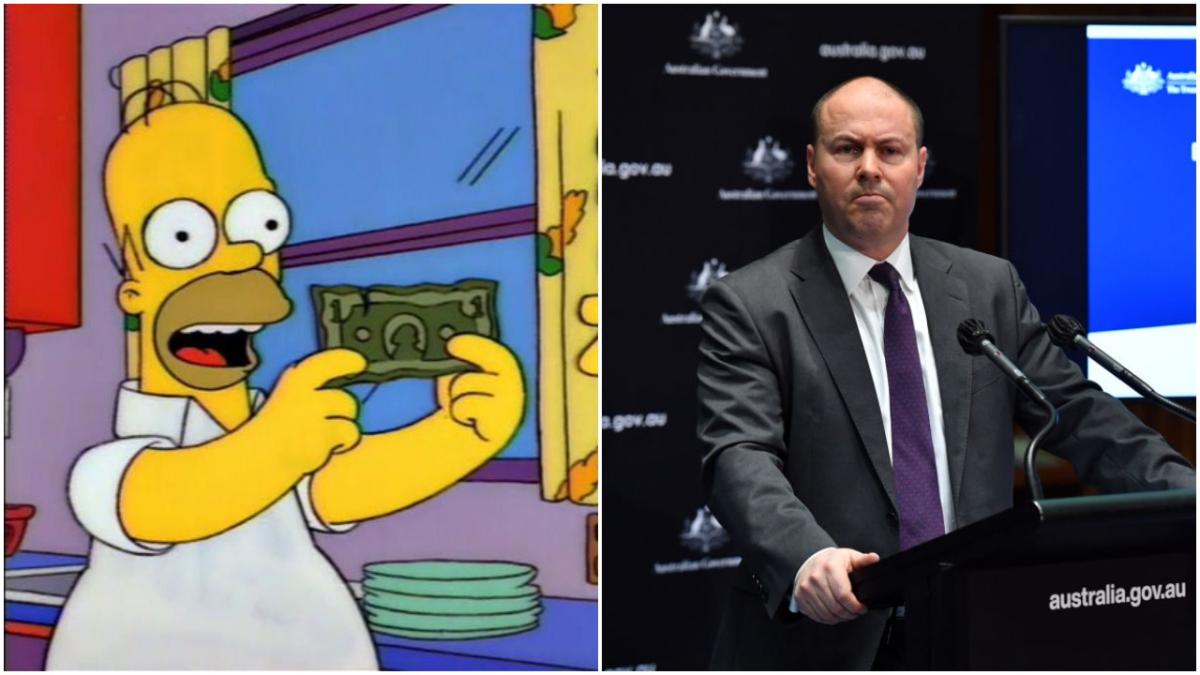

“This allows businesses that have taken on additional staff but are now subject by stage four restrictions to be be covered by the program.” Josh Frydenberg told Sunrise.

Essentially, this means if you were hired when life was seemingly going back to normal after the first wave, or you’ve changed jobs since March, you’re not going to be left out in the cold.

For Businesses:

The second change is a little more confusing if you’re not a business owner, but it will still have a big impact on workers, so pay attention.

When the extension to the programme was first announced, businesses were going to face tougher scrutiny surrounding eligibility and were set to have a harder time actually proving that the coronavirus pandemic was wreaking havoc on their profits. As you’d expect, this was likely going to mean less businesses would qualify for the payment, and therefore less workers would be covered.

TL;DR: not good for you.

Previously, businesses had to show that their GST turnover had fallen in the 2nd and 3rd financial quarters (ending in June and September, respectively) to be eligible for the first extension. But now, they only need to prove a 30% downturn in the September quarter.

The same deal goes for the second extension, with businesses only needing to show a fall in revenue in the December quarter, regardless of their performance in June and September.

To put it extremely simply, the easier it is for businesses to qualify, the less likely we are to see staff laid off as a result of restrictions and revenue loss amid the pandemic. All in all, this is good news for both businesses and employees.

What’s Not Changing:

Unfortunately, the new changes don’t impact the tapering off of the current rate, which will drop to $1,200 per fortnight on September 28, before dropping down to just $1,000 per fortnight on January 4.

Additionally, those of us working less than 20 hours per week will have payments cut to $750 per fortnight, then down to just $650 per fortnight in January.

Although Frydenberg has asserted that the rate will not change as the situation in Victoria (and other states) grows more extreme, Finance Minister Mathias Cormann says the government will make judgements based on the evolving information.

“Currently the arrangements are as they are, but as we’ve demonstrated, and as we’re demonstrating again today, we’ll continue to make judgements based on how this situation continues to evolve,” he said to Sky News.

The news comes as the national unemployment figure is set to hit a whopping 10% by the end of 2020, with the effective rate (which includes anyone currently working 0 hours but receiving government support) expected to be in the “high 13s,” according to Scott Morrison.

For context, the ABS estimated the unemployment rate to be 7.1% back in May.