We’ve teamed up with eftpos to school y’all on how to make better transaction decisions, every day. Pressing CHQ or SAV can make all the difference to your cash flow – find out how on their website HERE, Facey HERE and amongst #eftposeveryday.

ATM fees are the actual worst, especially when other countries in the world aren’t paying them.

Yep, Australia is one of just few countries forking out an extra $2-$3 if they want to get money out (a basic human right IMO) of an ATM which isn’t owned by their own bank provider. The banking industry likes to call these third-party or foreign ATMs, probably ’cause money-sucking pieces of shiitake was already taken by the likes of Gabi Grecko and Kris Humphries.

As you’re probably well aware, our want-it-now generation doesn’t exactly have the patience / energy to find an ATM of their own bank, especially if it’s only to save a few bucks. It’s true – a recent RateCity survey found that “Milennials aren’t overly concerned about hunting down their own ATMs to avoid fees, with 40 per cent admitting to using the wrong ATMs, compared to just 27 per cent of boomers.”

But unfortunately that spare change adds up, and the math ain’t fun.

As a matter of fact, in the last year alone Australia collectively spent $550 million in ATM fees. That’s a pretty crook statistic, especially considering they’re completely avoidable (like getting cash out via eftpos as well as other hacks) and because we’re only part of a small fraction of the globe coughing ’em up. Unsurprising, really, that a 2014 survey by research firm Galaxy found ATM fees to be the most hated of all charges imposed by Australian banks.

So glad you asked. Get this info into ya:

WHO ARE THE BIGGEST CULPRITS?

At present, Australia’s ATM network is currently dominated by four banks: National Australia Bank (NAB), Australia and New Zealand Banking Group (ANZ), Commonwealth Bank Australia (CBA) and Westpac.

However, some banks have even teamed up to be able to offer more machines to their customers, such as Commonwealth and Bankwest. Interestingly, 2015 reports showed that 55% of all ATMs were independently owned (the kind you find in pubs and festivals), which is up from 47% in 2010, meaning the likelihood of you paying a fee is high.

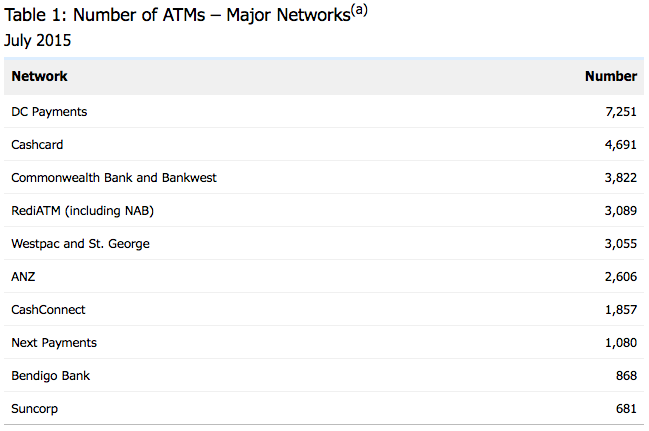

Below is a breakdown of how many ATMs each provider has in Australia:

Photo: Reserve Bank of Australia.

WHY ARE WE PAYING & WHERE DOES THE MONEY GO?

(Hint: it’s not thin air).

Before a reform was introduced by the Australian Payments Industry in 2009, we paid an interchange fee of around $1 (roughly half of what we’re paying now) for foreign transactions, but weren’t aware of the deduction until we saw our bank balance. After the reform was introduced, the prices went up as part of a new process which saw ATMs clearly disclose how much it would be charging you, while also giving you an option to opt out or continue.

The Reserve Bank of Australia says this enabled “owners to place ATMs in high-cost or low-volume locations where the interchange fee might previously have been insufficient to make an ATM commercially viable“. Basically, the fat cats of the Aussie banking industry claim that these fees are imposed to cover the fixed costs of maintaining their ATM networks.

Having a large ATM network (such as CBA and Bankwest) is a service to the bank’s customer base, and is also desirable for potential depositors. For example, if you’re with Suncorp you might consider switching to Commonwealth simply for the ATM availability and thus, lessen the burn of ATM fees. Because of this, financial institutions don’t have to rely solely on ATM fees to cover their fleets because they’ve got a solid customer base that pay in other ways. On the other hand, independent ATM providers (like Cashcard and DC Payments) don’t have this, so they essentially require ATM fees to exist.

Buttt, Matt Levey, head of campaigns at consumer group Choice, told The New Daily last year, “ATM fees are way out of proportion to the cost of providing the service, especially charging consumers for simply checking their bank balance.” He’s right. Research published by RBA last year states that the average cost borne by banks for issuing cash from an ATM is 77 cents, meaning the profit margin there is more than 100%.

This is where it all gets a little confusing. In 2013, NAB told Crikey that they made absolutely no profit from ATM fees and they were used entirely to fund ATM operations, and research by the RBA in 2011 said that the fees weren’t enough to cover the costs.

HOW CAN WE AVOID THESE FEES AT ALL COSTS? (LOL GEDDIT)

While the information out there is truly all over the shop – if one thing’s for sure, it’s that Aussies bloody hate ATM fees. Fortunately, though, the amount of money we (as a country) are spending on foreign transactions continues to decline. This is partly due to the increase in technological transactions (almost everywhere now lets you pay by card) and account-balance checking. Here’s what else you can do to avoid the fees:

GET CASH OUT WHEN YOU PAY FOR SUMMIN’ ELSE: Y’know how that check-out chick at Woolies who always asks if you’d like cash out before your payment goes through? You should listen to her. She’s got your best interests at heart. Use the opportunity to get as much money out as you’d like without copping a fee. Remember, if you tap and go, that’s not possible. Press CHQ or SAV to get your dosh out via eftpos.

JUST PAY WITH CARD EY: Hello! Welcome to 2016! We allow you to pay by card almost everywhere! It’s nuts! Seriously tho – why you using cash if you don’t have to?

WITHDRAWAL IN BULK: If you’re getting $20 out and paying $2 to do so, that’s a 10% profit for the bank of the ATM you’re using. Try upping your withdrawal amount so that the money you get out goes the distance, but don’t go too crazy. No one likes carrying around bulk cash, ’cause, well, it looks like you’ve got a side-hustle happening, if you know what we mean.

USE AN ATM LOCATOR / APP: Local banks have tools on their websites / mobile apps that help you find your nearest ATM, and using these means you can check your account balance on there too.