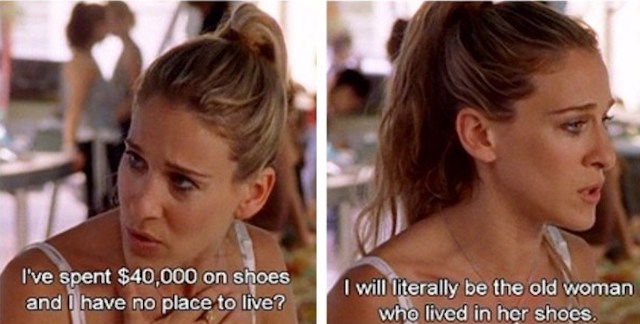

If the past couple of months have taught us anything, it’s that nothing in life is certain – and yes, as many of us found out the hard way, that includes finances. If there’s ever been a time to start being savvier with your funds, it’s now, as we potentially reassess our past, present and future spending habits.

So, allow me to introduce you to a little term called ‘bucketing’.

Bucketing is not the verb for pounding potent cocktails on a beach in Thailand – it’s actually a style of budgeting, and budgeting is that thing you do so you can afford said cocktails on aforementioned beach.

Even if you’re not thrifty, failed math methods and are all-round the opposite of a financial prodigy, you could find it quite a banking no-brainer to get around bucketing.

It can be simple, efficient, and you can even make it direct debit.

It’s like the old school envelope budget.

You know, when your mum or dad would stuff cash in different envelopes – one labelled RENT, another labelled EMERGENCY, the third labelled BIRTHDAYS etc.

The envelope system seemingly worked for mum and dad because it ensured they had all their financial bases covered. For example, they could always keep a roof over your head, clothes on your back and fish fingers in the freezer.

But even if you don’t have kids to house and clothe and feed, bucketing is still a super useful way to manage your money, and right now could be a stellar time to start. After all, what else are you doing in iso besides zoom calls, DM’ing your ex and whispering to a sourdough starter?

But how does one begin bucketing?

Choose thy buckets

First off, decide on your buckets. Are you paying rent or got a mortgage? That’s usually a bucket people create. Saving for a post-COVID holiday? Why not give that its own bucket? Life essentials like groceries and bills? Probably worth a bucket.

Everyone’s buckets will be different, because everyone’s leading different lives. The very excellent thing about bucketing is you can easily rename and shuffle your buckets if your priorities shift. Flexibility and freedom, we love it.

Get out thy calculator

This is where we crunch those numbers, do that math, put your one economics elective to good use. It can be useful to decide ahead of time what percentage of your income is going into each bucket. This can take a little adjusting over time but STICK WITH IT YOU GOT THIS GOOD JOB. If you’re super stuck though, there’s always this nifty budget planner you can try which basically does the math for you.

Open thy accounts

You might want to consider something like this Bankwest Easy Transaction Account because you can open up to 10 different accounts which can be quite perfect bucketing. Are you excited? We are. But don’t forget to name your bucket accounts otherwise your whole system will be a messy mess.

Make it work for thee

Got lofty budgeting goals? Firstly, go you. Love to see people aiming high.

Secondly, you can use a nifty tool, like this one, to create your goal, schedule regular payments and track your savings progress, all in one place. You can also set up direct debit payments into your buckets if you’re a forgetful sort of fella. Make the technology work for you, and your money, and install in your everyday behaviour as a banking no-brainer.

Anyway, if you wanna break your splurging habits or quit spending your entire paycheck on food delivery services, bucketing might just be the way forward.

You never know, there might be a long island iced tea on Koh Phi Phi beach at the end of the budgeting tunnel (post-pandemic, obvs).

Best start saving, eh?

Of course, all these don’t take your objectives or financial situation into account and you should seek relevant professional advice.